What Is Bridging Software?

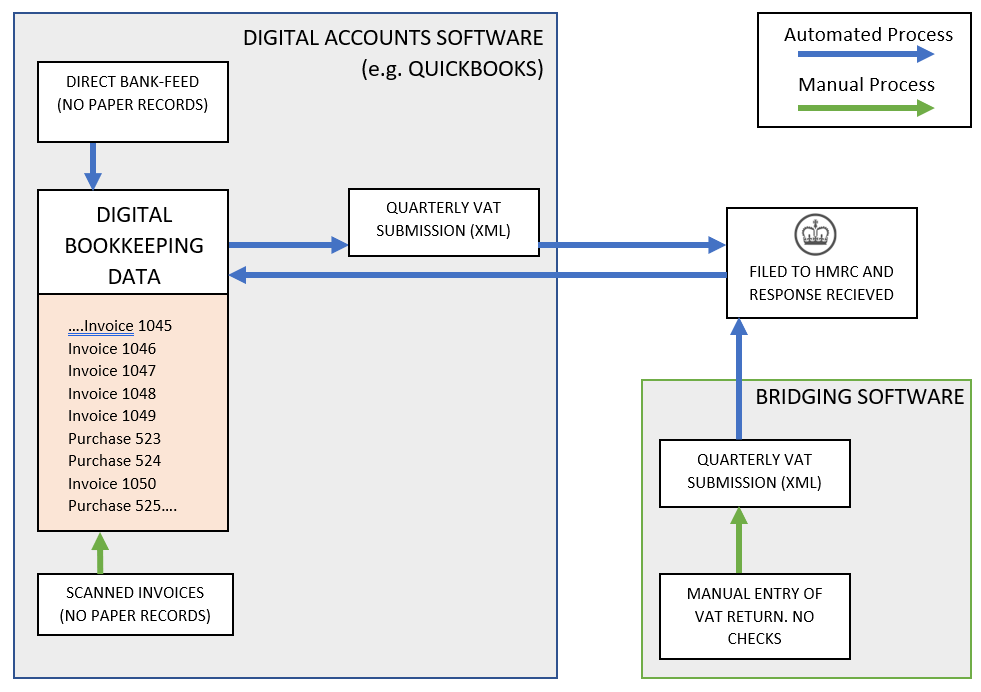

Bridging software allows you to manually enter the details that would normally appear on a VAT submission, and converts this into the XML form required to submit through the MTD API. (See our full explaination of the MTD API process here.)

This gives the ability to file VAT returns without having a full digital accounts package setup behind it. However, we strongly believe that this is not the correct approach to Making Tax Digital and HMRC have made it clear in their releases that they expect businesses to keep full digital records, regardless of whether bridging software is in use or not.

That’s not to say there isn’t a place for bridging software. The April 2019 deadline is very close, and for many businesses they are not prepared for the change. In this case, bridging software could be used as respite. However, the risks are not eliminated, and anyone using bridging software should be also looking to adopt a more practical and future-proof digital accounting solution as soon as possible. This doesn’t have to be a difficult transition, as Llewellyns Accountants have already helped over 300 businesses through this process.