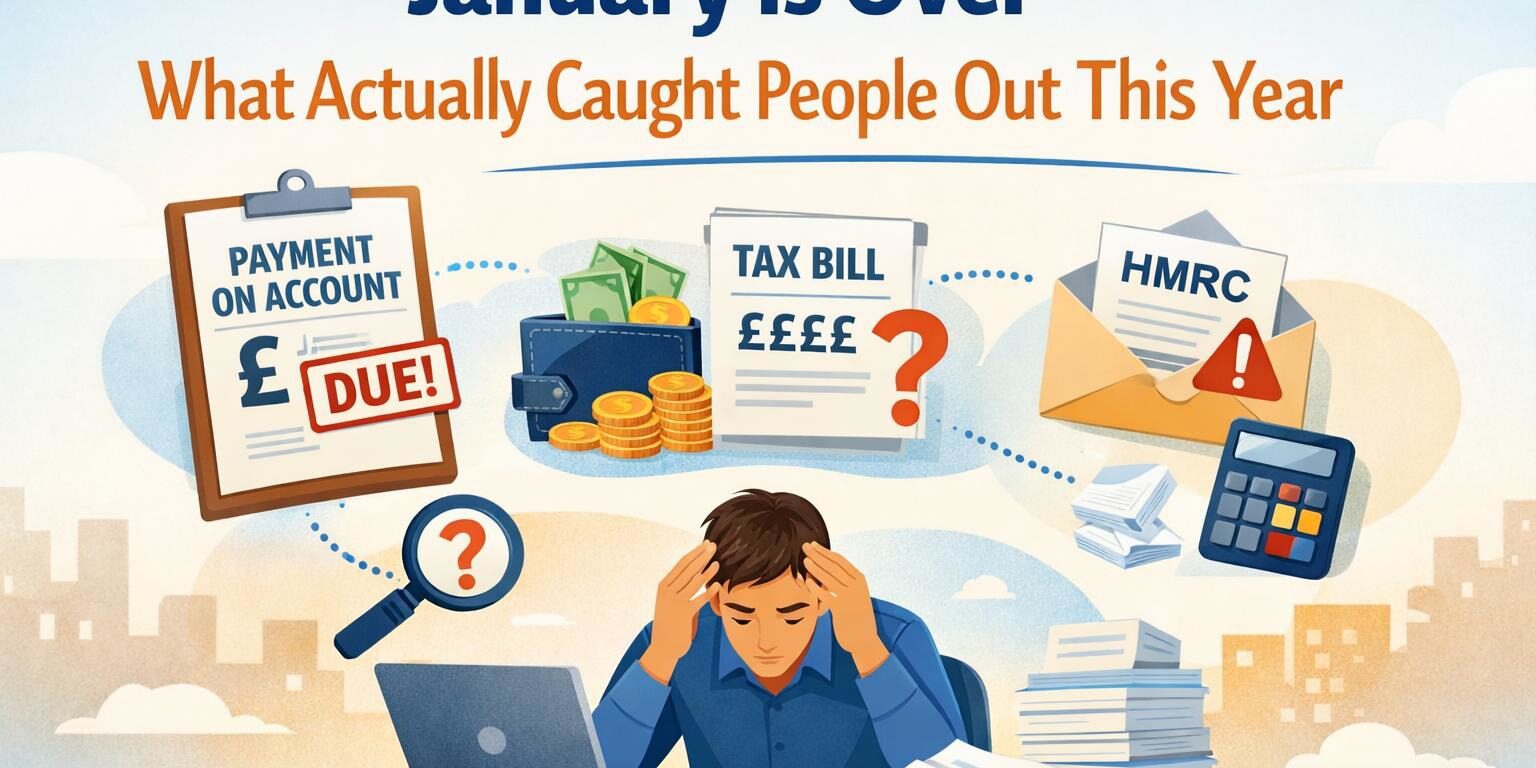

January Is Over! Here’s What Actually Caught People Out This Year

Now that January is behind us, the rush of Self Assessment has finally eased.

Every year, once the deadline passes, we take a step back and reflect on what actually caused problems for people, not in theory, but in real life, dealing with real returns and real businesses.

And while no two years are ever identical, some clear patterns always emerge.

Here’s what caught people out this January 👇

📅 “I Didn’t Realise That Was Due Too”

One of the biggest surprises we see every year isn’t the tax return itself, it’s what’s due alongside it.

For many people, January doesn’t just include:

the balancing payment for the year just ended, but also

a payment on account towards the next tax year.

This often leads to the question:

“Why is my tax bill so much higher this year?”

In most cases, nothing unusual has happened, it’s simply the structure of the system. But if you’re not expecting it, it can feel like a shock.

💷 Profit vs Cash (Still Catching People Out)

This one never really goes away.

We regularly speak to business owners who:

had a “good year” on paper 📈

but didn’t have the cash sitting there when the tax bill arrived

Tax is calculated on profit, not the balance in your bank account, and if money has already been reinvested or withdrawn, it can create pressure when January comes around.

January has a habit of highlighting cashflow weaknesses that were easy to ignore during the year.

🧾 “I Thought That Was Already Included”

Another common theme is missing or misunderstood income.

Examples we saw this year include:

small additional income streams

interest or side income forgotten about

CIS deductions misunderstood

figures assumed to be “already dealt with”

None of these are unusual, but they often come to light late in the process, adding unnecessary stress in the final weeks.

⏰ Leaving It Later Than Planned

Most people don’t plan to leave things until January.

But we often hear:

“I meant to sort this earlier”

“I didn’t think it would take long”

“I just needed one last figure”

January has a way of speeding up, and once deadlines loom, even small issues can feel bigger than they need to be.

📬 Confusion After Filing

Interestingly, some of the most common questions arise after returns have been submitted.

People are often surprised by:

HMRC statements showing future payments

July dates already appearing

letters that look worrying but aren’t

Without context, these can cause unnecessary concern, when in reality, they’re often just part of the normal tax timeline.

💡 What January Tends to Teach

If January shows us anything, it’s that:

tax problems are rarely caused by one big mistake

they’re usually the result of small misunderstandings building up over time

The good news is that many of these issues are avoidable with earlier clarity, long before January arrives again.

🌱 Final Thoughts

January may be over, but what it reveals about a business’s finances is worth paying attention to.

Understanding:

how your tax is calculated

what’s due and when

and how cashflow fits into the picture

can make future deadlines far calmer and far more predictable.

At Llewellyns, we believe tax works best when it’s understood throughout the year, not just rushed through at the end.