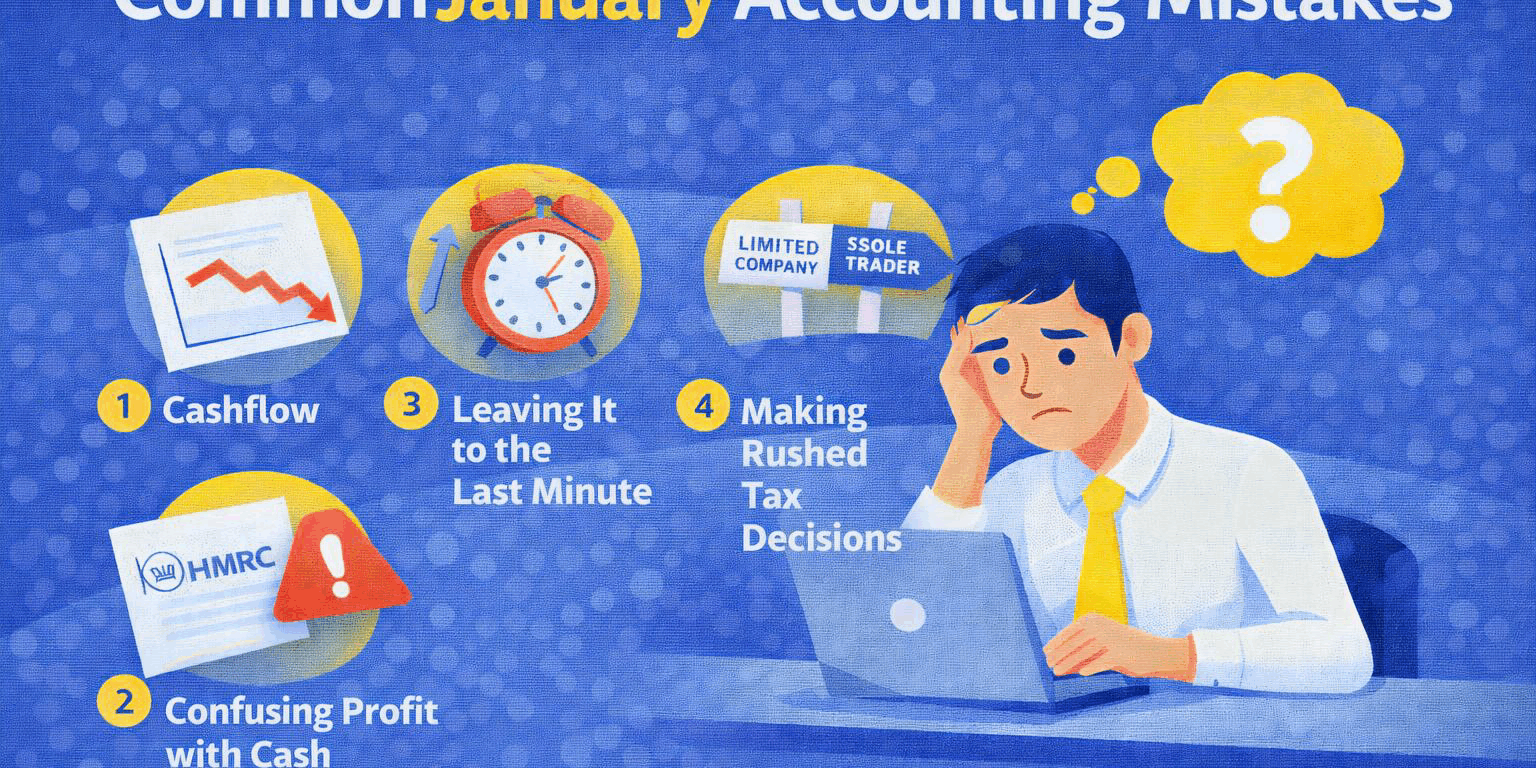

❌ Common January Accounting Mistakes We See Every Year

January is one of the busiest and most stressful months of the year for business owners.

Deadlines, tax bills, HMRC letters and cashflow pressure all land at once — and that combination often leads to avoidable accounting mistakes 😬.

Most of these aren’t caused by carelessness. They’re caused by:

Time pressure

Assumptions

Trying to “just get through January”

Below are the most common January accounting mistakes we see every year, and how to avoid them.

1️⃣ Ignoring cashflow because “January is always bad”

Many business owners accept January as a write-off and stop paying attention to cashflow.

While January can be quieter, ignoring cashflow completely can lead to:

Missed tax payments

Overdraft reliance

Unnecessary stress

📌 Even in January, knowing:

what’s coming in

what’s going out

what’s due

…makes a big difference.

2️⃣ Confusing profit with cash 💷

This one appears every year.

A business can:

Make a profit

Still feel short of cash in January

That’s because tax, VAT and other liabilities are often paid after the income was earned.

January exposes the gap between profit and cash more than any other month — and misunderstanding that gap leads to panic decisions.

3️⃣ Leaving everything until the last minute ⏰

January deadlines are fixed — but many people still try to deal with:

Tax returns

Payments

HMRC queries

…right at the end of the month.

This increases the risk of:

Errors

Missed deadlines

Unnecessary penalties

January is stressful enough without self-inflicted pressure.

4️⃣ Assuming HMRC letters mean something has gone wrong 📬

Receiving a letter from HMRC in January often triggers immediate worry.

In reality, many January letters are:

Automated

Routine

Informational

Assuming the worst before understanding the letter often causes unnecessary anxiety — and sometimes leads to rushed responses.

5️⃣ Making rushed tax decisions

January tax bills often prompt thoughts like:

“I need to change structure”

“I’m paying too much tax”

“Something must be wrong”

While these questions are valid, January is rarely the right time to make big tax decisions.

Rushed decisions made under pressure don’t usually produce good long-term outcomes.

6️⃣ Forgetting upcoming liabilities

Another common January mistake is focusing only on what’s due now.

It’s easy to forget about:

31 July payments on account

VAT bills

PAYE obligations

Corporation tax

January should be about understanding the full picture, not just surviving the month.

7️⃣ Trying to deal with everything alone

January can feel isolating for business owners.

Trying to handle:

Tax calculations

HMRC correspondence

Cashflow issues

…without asking questions often makes things feel worse than they are.

A quick conversation or clarification early on can prevent weeks of unnecessary stress.

✅ A better way to approach January

January doesn’t need to be perfect — it just needs to be managed calmly.

A sensible approach is to:

✔ Understand what’s due

✔ Separate stress from reality

✔ Avoid rushed decisions

✔ Ask questions early

January is a month for clarity, not criticism.

🌱 Final thoughts

Every January, we see the same patterns — and the same avoidable mistakes.

Most aren’t serious. Most don’t mean anything has gone wrong. And most can be avoided with a bit of understanding and planning.

At Llewellyns, our focus is on keeping accounting and tax clear, practical and calm, especially during busy periods like January.

If something doesn’t look right, it’s always better to check early than worry in silence.