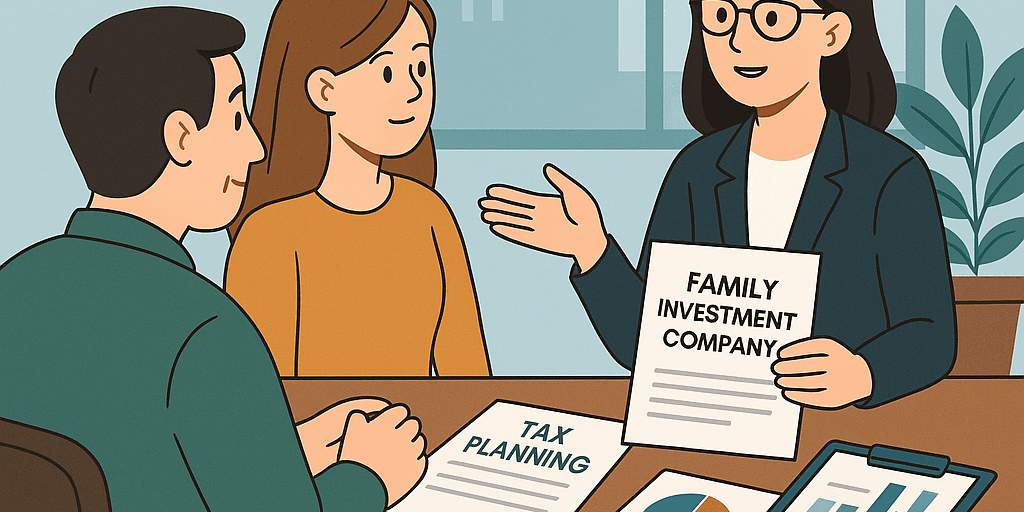

💼 Family Investment Companies in the UK 2025/26: The Pros and Cons Explained

As family wealth grows — often through business profits, property, or long-term investments — many families start to look for tax-efficient ways to protect assets for future generations.

One option that’s gained popularity in recent years is the Family Investment Company (FIC).

But what exactly is a Family Investment Company, and is it the right fit for your family? Let’s break it down 👇

🏢 What Is a Family Investment Company (FIC)?

A Family Investment Company is a private limited company that holds and manages family wealth — typically investments, cash, or property — for the benefit of family members.

Rather than holding assets personally or through trusts, the assets are owned by the company.

Family members then hold shares in the company, giving control and ownership flexibility.

✅ The Key Benefits (Pros)

1️⃣ Tax Efficiency

FICs are subject to Corporation Tax (currently 25%) on profits, which is often lower than personal Income Tax rates.

Dividend income from UK shares is usually exempt from Corporation Tax, meaning reinvested income can grow efficiently inside the company.

Gains on investments are taxed at Corporation Tax rates, not higher Capital Gains Tax rates faced by individuals.

2️⃣ Control & Flexibility

Parents (or older family members) can retain control as directors, while younger generations hold shares.

Different share classes can be created to control voting rights, income, and inheritance planning.

3️⃣ Inheritance Tax (IHT) Planning

Shares in the company can be gifted over time to family members, potentially reducing the value of the parents’ estate for IHT purposes.

Since control is retained through directorships, parents can continue managing the assets while transferring value tax-efficiently.

4️⃣ Asset Protection

Assets held within a company can be shielded from certain personal risks, offering a layer of protection if structured properly.

⚠️ The Potential Drawbacks (Cons)

1️⃣ Complexity & Setup Costs

Creating and maintaining a FIC involves legal, tax, and accounting input — including tailored articles of association and shareholder agreements.

They are not “DIY” structures; expert guidance is essential.

2️⃣ Corporation Tax & Extraction Costs

While Corporation Tax rates can be lower, extracting profits from the company (e.g. through dividends or salaries) can trigger additional Income Tax for shareholders.

You’ll need to plan carefully to avoid losing the benefit of the lower tax rate.

3️⃣ Administrative Burden

FICs must file annual accounts and corporation tax returns, and maintain statutory records — unlike personal investment portfolios.

Ongoing compliance costs should be factored in.

4️⃣ Limited Availability of Reliefs

Some trust-based IHT reliefs (like Business Relief) won’t apply to passive investment companies.

FICs can be tax-efficient, but they are not a substitute for all trust benefits.

💡 Who Might a FIC Suit?

FICs are often used by:

Families with significant investable assets (typically £1m+)

Business owners who have sold a company and want to reinvest proceeds tax-efficiently

Parents looking to pass on wealth gradually while keeping control

If you have smaller assets or prefer simplicity, traditional investment accounts or trusts may be more suitable.

🧾 Final Thoughts

A Family Investment Company can be a powerful structure for long-term family wealth management — but it’s not a one-size-fits-all solution.

The best approach depends on your goals, family dynamics, and the value of assets involved.

💬 At Llewellyns Chartered Certified Accountants, we help clients design structures that balance tax efficiency, control, and flexibility — and ensure they’re compliant every step of the way.

📞 Call us on 02920 624 230

📞 Call us on 01443 303 230

📧 Email info@llewellyns.co.uk